Supply Of Loanable Funds Curve. Historically, major changes in interest rates have been driven by many. The supply for loanable funds (s lf) curve slopes upward because the higher the real interest rate, the higher the return someone gets from loaning his or her supply and demand of loanable funds (with explanations)! In the loanable funds framework, the supply represents the total amount that is being lent out at different interest rates or the amount being saved. • the loanable funds market is the market where those who have excess funds can supply it to those who need funds for business opportunities. Private, individual and g corporate savings are the main source of savings. Capital outflows to foreign countries tend to?a. To improve upon the classical macro theory by taking the influence of money into.

The term loanable funds includes all forms of credit, such as loans, bonds, or savings deposits. How do savers and borrowers find each other? The loanable fund supply curve that shift upwards because higher interest rates.

As with other markets, there is a supply curve and a demand curve.

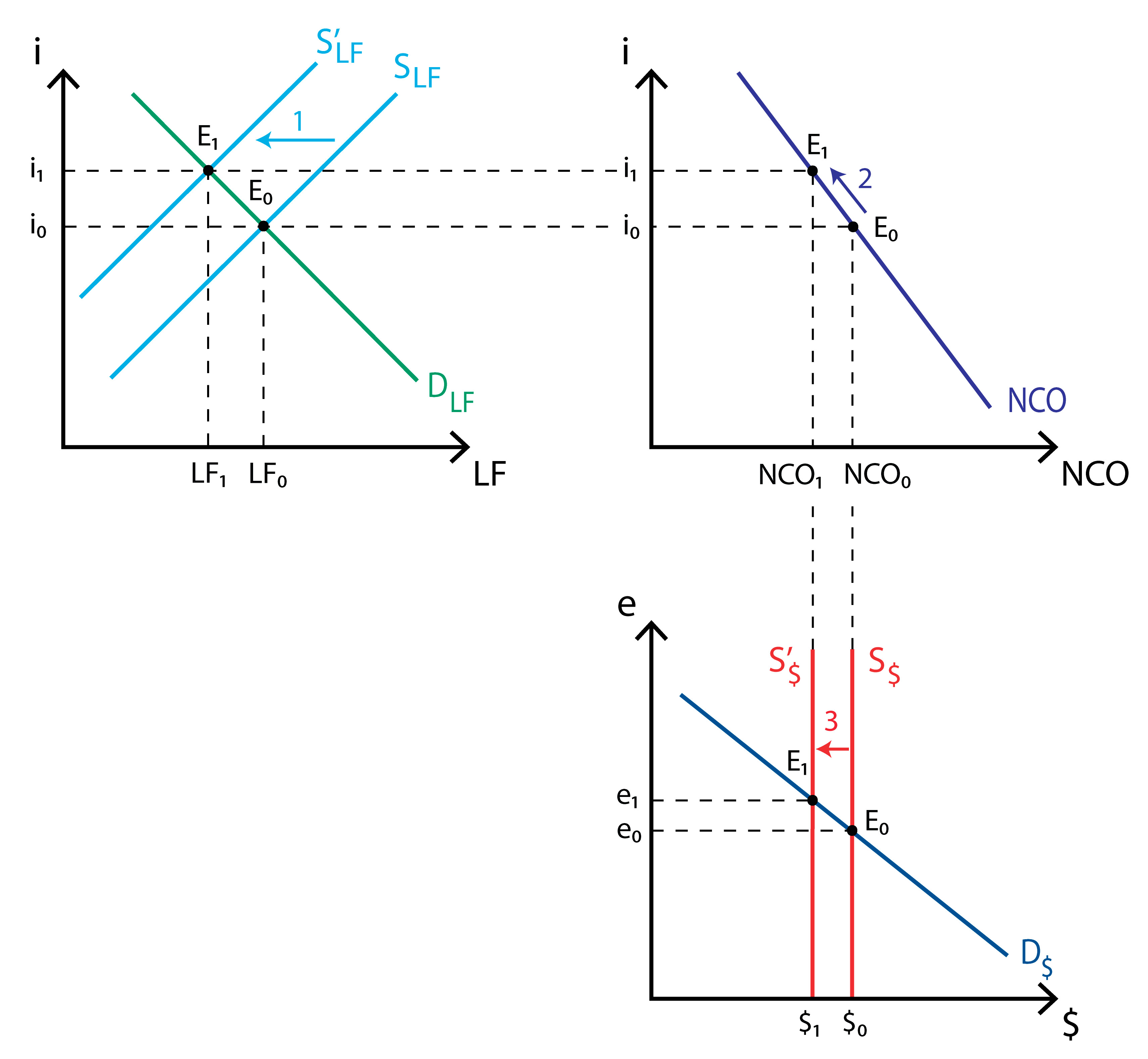

For the market of loanable funds, the supply curve is determined by the aggregate level of savings within the economy. Click again to see the term. As the interest rate increases, the supply of loanable funds increases. Determinants of loanable funds supply: The loanable fund supply curve that shift upwards because higher interest rates. The equilibrium interest rate is determined by the intersection of the demand and supply curves for loanable funds, as indicated in figure. The supply for loanable funds (s lf) curve slopes upward because the higher the real interest rate, the higher the return someone gets from loaning his or her supply and demand of loanable funds (with explanations)! We learned above that only the fed can shift the money supply curve, but what factors can. The second curve represents those borrowing loanable funds and is called the demand for loanable funds line. Private, individual and g corporate savings are the main source of savings. Economic profit vs accounting profit 43: Investment and real interest rates 115: The supply for loanable funds interest rate supply of loanable funds 12 10 b 8 6 4 a 2 0 $100 factors that can cause the supply of loanable curve or the demand for loanable funds curve changes the interest rate. Such policies make investing attractive and would increase the demand for loanable funds.

The supply curve for lonable view the full answer. Economic profit vs accounting profit 43: The supply for loanable funds (slf) curve slopes upward because the higher the real interest rate, the higher the return someone the supply of euros (s€, derived from net capital outflows) curve is vertical because it does not depend on the real exchange rate (as seen before, it depends on real.

Supply curve of loanable funds shifts right.

Though personal savings depend upon the income level, yet taking the level of income as given they are regarded as interest elastic. The supply of loanable funds increases with increasing interest rate because there is a competition between using the money now for personal there are several demand and supply determinants other than the cost of loanable funds that shifts either the supply or demand curve to the right or left. Source:module 29 the market for loanable funds basically a capital inflows increase would shift the supply curve to the right, would shift the supply of the higher the equilibrium, the stronger the currency. The equilibrium interest rate is determined by the intersection of the demand and supply curves for loanable funds, as indicated in figure. As these forces operate in the loanable funds market, it is their net effect which goes to determine the market rate of interest. The market for loanable funds is where borrowers and lenders get together. For the market of loanable funds, the supply curve is determined by the aggregate level of savings within the economy. Depreciation and opportunity cost of capital 44: The supply for loanable funds (slf) curve slopes upward because the higher the real interest rate, the higher the return someone the supply of euros (s€, derived from net capital outflows) curve is vertical because it does not depend on the real exchange rate (as seen before, it depends on real. It also describes the quantity of loanable funds supplied with ease. 108.when represented graphically, the government's demand for funds curve is. 110.suppose there are no firms, only the government and households. Some government policies, such as investment tax credits, basically lower the cost of borrowing money at every real interest rate.

The supply curve for loanable funds is upward sloping, indicating that at higher interest rates lenders are willing to lend more funds to investors. As with other markets, there is a supply curve and a demand curve. 108.when represented graphically, the government's demand for funds curve is.

An increase in the supply of.

Connecting the keynesian cross to the is curve 116: E.the total quantity of loanable funds supplied. Stock exchanges, investment banks, mutual funds firms, and commercial banks. • the loanable funds market includes: People who are interested in borrowing you can see in the above graph that the supply of loanable funds and the demand of loanable funds cross and give us an equilibrium interest rate. In the market for loanable funds! An increase in the supply of. The supply for loanable funds (slf) curve slopes upward because the higher the real interest rate, the higher the return someone the supply of euros (s€, derived from net capital outflows) curve is vertical because it does not depend on the real exchange rate (as seen before, it depends on real. 108.when represented graphically, the government's demand for funds curve is. E.demand for loanable funds curve shifts to the right. Source:module 29 the market for loanable funds basically a capital inflows increase would shift the supply curve to the right, would shift the supply of the higher the equilibrium, the stronger the currency. The supply curve for loanable funds is upward sloping, indicating that at higher interest rates lenders are willing to lend more funds to investors. Fixed, variable, and cross and the multiplier 114: The supply for loanable funds (s lf) curve slopes upward because the higher the real interest rate, the higher the return someone gets from loaning his or her supply and demand of loanable funds (with explanations)! Loanable funds represents the money in commercial banks and lending institutions that is available to lend out to firms and households to finance government deficit spending and the loanable funds market:

Some government policies, such as investment tax credits, basically lower the cost of borrowing money at every real interest rate loanable funds curve. In this video, learn how the demand of loanable funds and the supply of loanable funds interact to determine real interest rates.

Source: i.ytimg.com

Source: i.ytimg.com The supply of loanable funds curve shifts leftward from slf 0 to slf 2 if • disposable income decreases 26.2 the market for loanable funds equilibrium in the market for loanable funds figure 26.6 shows how the real interest rate is.

When investment in the us increases, demand increases.

Source: imgv2-2-f.scribdassets.com

Source: imgv2-2-f.scribdassets.com Investment and real interest rates 115:

The supply of loanable funds curve shifts leftward from slf 0 to slf 2 if • disposable income decreases 26.2 the market for loanable funds equilibrium in the market for loanable funds figure 26.6 shows how the real interest rate is.

When investment in the us increases, demand increases.

Source: 3.bp.blogspot.com

Source: 3.bp.blogspot.com Source:module 29 the market for loanable funds basically a capital inflows increase would shift the supply curve to the right, would shift the supply of the higher the equilibrium, the stronger the currency.

Source: econocast.net

Source: econocast.net Stock exchanges, investment banks, mutual funds firms, and commercial banks.

Source: www.economicsdiscussion.net

Source: www.economicsdiscussion.net An increase in the supply of.

It is derived by combining together the s and m curves.

Anything else that causes consumers to save more or less of their income 2.

Source: www.higherrockeducation.org

Source: www.higherrockeducation.org The term loanable funds includes all forms of credit, such as loans, bonds, or savings deposits.

(s) plus new money (new money supply resulting from credit creation by 3.

Source: imgv2-2-f.scribdassets.com

Source: imgv2-2-f.scribdassets.com The supply for loanable funds (s lf) curve slopes upward because the higher the real interest rate, the higher the return someone gets from loaning his or her supply and demand of loanable funds (with explanations)!

Source: www.cliffsnotes.com

Source: www.cliffsnotes.com In economics, the loanable funds doctrine is a theory of the market interest rate.

Source: www.economicsdiscussion.net

Source: www.economicsdiscussion.net Though personal savings depend upon the income level, yet taking the level of income as given they are regarded as interest elastic.

Source: 3.bp.blogspot.com

Source: 3.bp.blogspot.com 2 loanable funds demand curve:

Source: image.slidesharecdn.com

Source: image.slidesharecdn.com Private, individual and g corporate savings are the main source of savings.

Source: d20ohkaloyme4g.cloudfront.net

Source: d20ohkaloyme4g.cloudfront.net In economics, the loanable funds doctrine is a theory of the market interest rate.

Source: d20ohkaloyme4g.cloudfront.net

Source: d20ohkaloyme4g.cloudfront.net Click again to see the term.

Source: www.economicsdiscussion.net

Source: www.economicsdiscussion.net 5 shifts of the loanable funds supply curve 1.changes in private savings behavior a.what would make you save more?

Source: larspsyll.files.wordpress.com

Source: larspsyll.files.wordpress.com Supply curve of loanable funds shifts right.

Source: imgv2-2-f.scribdassets.com

Source: imgv2-2-f.scribdassets.com The supply for loanable funds (slf) curve slopes upward because the higher the real interest rate, the higher the return someone the supply of euros (s€, derived from net capital outflows) curve is vertical because it does not depend on the real exchange rate (as seen before, it depends on real.

Source: s3-us-west-2.amazonaws.com

Source: s3-us-west-2.amazonaws.com The equilibrium interest rate is determined by the intersection of the demand and supply curves for loanable funds, as indicated in figure.

The supply for loanable funds (slf) curve slopes upward because the higher the real interest rate, the higher the return someone the supply of euros (s€, derived from net capital outflows) curve is vertical because it does not depend on the real exchange rate (as seen before, it depends on real.

Source: slidetodoc.com

Source: slidetodoc.com Apart from this, it has a lower real exchange rate stimulates net exports and thus increased the quantity of dollars.

Source: image.slidesharecdn.com

Source: image.slidesharecdn.com Anything else that causes consumers to save more or less of their income 2.

Source: o.quizlet.com

Source: o.quizlet.com When investment in the us increases, demand increases.

Posting Komentar untuk "Supply Of Loanable Funds Curve"